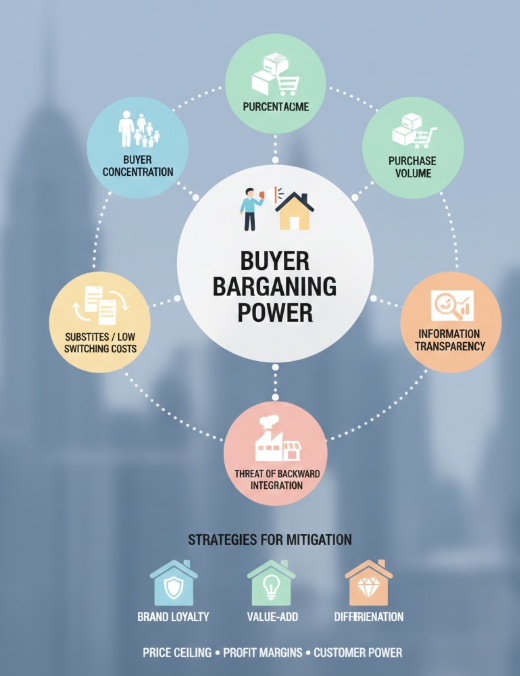

The “Bargaining Power of Buyers” represents the pressure customers can exert on companies to lower prices, demand higher quality, or seek additional services. When buyers possess significant leverage, they force companies to compete for their business, which often leads to decreased prices and increased operational costs, ultimately eroding the organization’s net profits.

1. Factors That Grant Buyers Power

-

Buyer Concentration: When there are few customers but many sellers, the buyer holds “the power of choice” and can dictate terms (e.g., the relationship between spare parts factories and major car manufacturers).

-

Purchase Volume: A customer who buys in massive quantities has more leverage to demand discounts and facilities that a regular customer wouldn’t receive.

-

Availability of Substitutes and Switching Costs: If the product is “standardized” and available from many competitors, and the customer can switch without incurring costs, their power becomes immense.

-

Information Transparency: In the digital age, customers know production costs and competitors’ prices accurately, strengthening their negotiating position.

-

Threat of Backward Integration: A buyer holds significant power if they can manufacture the product themselves (e.g., a beverage company deciding to manufacture its own cans instead of buying them).

2. Practical Example (Retail Giants and Suppliers)

Consider the relationship between Hypermarkets and small food suppliers. Since the giant retailer buys in huge volumes and represents the primary channel to reach thousands of consumers, it holds terrifying bargaining power. The retailer can dictate very low prices, demand long payment terms, or even charge fees for displaying products on front shelves, leaving the small suppliers with razor-thin profit margins.

The bargaining power of buyers is what dictates the “price ceiling.” Successful companies do not just sell a product; they build added value and strong brand loyalty that makes the customer stay even if prices rise, thereby reducing the buyer’s leverage and protecting the organization’s profits.