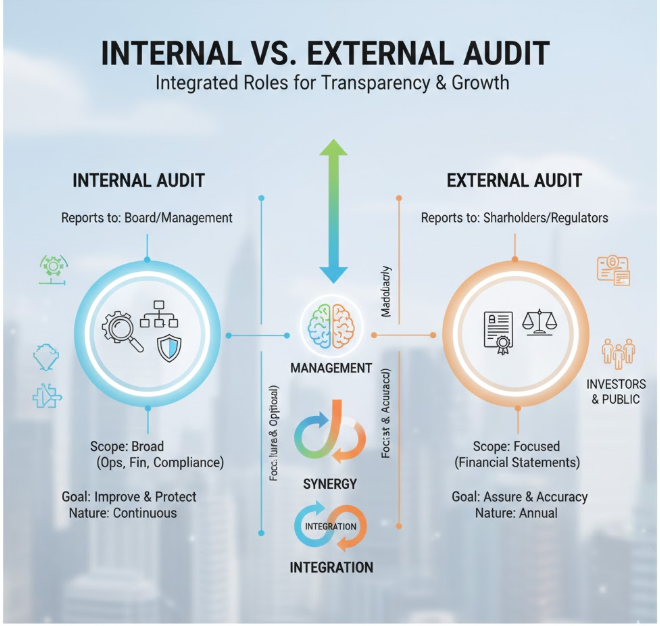

In modern management, auditing is viewed as the “defense system” protecting an organization. A fundamental question often arises: Why does a company need two sets of auditors? The answer lies in complementary roles: Internal audit acts as a permanent “immune system,” while external audit represents the “comprehensive annual check-up” providing credibility to the financial community.

1. Internal Audit: The Resident Consultant and Development Partner

Internal auditing is a strategic function that goes far beyond reviewing accounting entries. It is an independent evaluation activity designed to add value and improve organization operations.

-

Independence and Reporting: The internal auditor holds a unique organizational position; they are an employee but report functionally to the Audit Committee of the Board. This provides the necessary independence to offer unbiased critiques of operational and executive deviations.

-

Scope and Objective: The internal auditor dives into “efficiency and effectiveness.” They don’t just ask if the numbers are correct, but if processes are optimal. They examine technology risks, task distribution, and management efficiency. It is a continuous process, working year-round to correct paths as deviations occur.

2. External Audit: The Stamp of Credibility for Shareholders

On the other side, external auditing represents the regulatory peak from a legal and investor perspective. The external auditor is an entirely independent third party with no employment ties to the organization.

-

Responsibility: Their primary responsibility is to shareholders and government regulators. They act as the voice of truth, reassuring banks and investors that the financial statements reflect the organization’s financial reality fairly and clearly.

-

Scope and Reporting: External auditing is specifically scoped and based on materiality. It focuses on major transactions affecting the financial position. It operates on a periodic (usually annual) basis, and its primary output is the “Auditor’s Report,” which builds market and lender confidence.

3. Harmony Between Internal and External: Creating Excellence

The relationship between internal and external auditors is not duplicative; it is synergistic. Upon starting, the external auditor assesses the strength of the internal audit system. A robust internal system allows the external auditor to rely on existing data, enhancing the overall efficiency of the regulatory process.

A professional accountant understands that internal audit paves the way by fixing operational flaws, while external audit reaps the rewards of this discipline, presenting it to the world as documented success. Internal audit focuses on “how work is done” for continuity, while external audit focuses on “work results” for transparency.

Internal audit is the “Strategic Partner” working from within to ensure operational efficiency and continuous asset protection, while external audit is the independent “Stamp of Quality” that grants financial figures credibility before the world. A successful organization does not rely on one over the other but creates harmony between them; the internal auditor paves the way with discipline and prevention, while the external auditor validates this discipline with accuracy and transparency.