If accounting is the “language of business,” then financial auditing is the “grammar” that ensures the accuracy of this language. A financial audit is not just a routine procedure; it is a systematic examination of an organization’s financial statements to ensure they represent the financial reality fairly and without misrepresentation, whether caused by human error or deliberate fraud.

1. Objectives of a Financial Audit

Financial auditing seeks to achieve three primary goals:

-

Providing a Professional Opinion. Offering reasonable assurance that financial statements (Balance Sheet, Income Statement, Cash Flow) are prepared in accordance with approved accounting standards.

-

Detecting Material Errors. Searching for significant financial deviations that might influence the decisions of the users of these statements.

-

Assessing Going Concern. Ensuring that the entity has sufficient capacity to continue its operations in the foreseeable future and is not facing sudden bankruptcy.

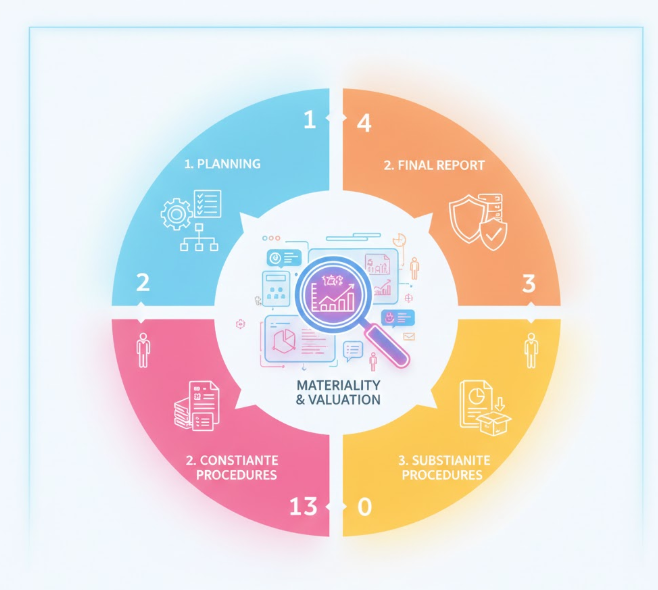

2. Stages of the Financial Audit Process

The audit process undergoes a structured journey to ensure accuracy:

-

Planning Phase. Understanding the nature of the business, assessing risks, and determining the size of the samples to be examined.

-

Internal Control Testing. Examining the company’s accounting systems; if internal controls are strong, detailed testing is reduced, and vice versa.

-

Substantive Procedures. Actual examination of documents, matching bank balances, and physical inventory counts of assets and stock.

-

Final Report. Issuing the auditor’s report, which may be (Unqualified/Clean), (Qualified), or (Adverse) based on the evidence found.

3. Core Elements Focused on by the Auditor

The financial auditor dives into the details of vital operations:

-

Verification of Existence. Do the assets recorded in the books actually exist in reality?

-

Completeness. Have all expenses and liabilities been recorded, or are there hidden amounts?

-

Valuation and Measurement. Have inventory, assets, and foreign currencies been valued at the correct and fair values?

A financial audit is the “birth certificate” of credibility for any company. For you as an accountant or financial manager, understanding how a financial auditor works enables you to organize your company’s books professionally, reducing risks and attracting investors. Always remember: “Numbers don’t lie, but they need someone to verify their truth.”