Financial success is not merely a result of mathematical genius or a complex understanding of stock market indicators; rather, it is the product of a delicate balance between economic awareness and behavioral discipline. The truth often overlooked is that successful financial management is more about your personal behavior than your IQ. In the hands of a conscious individual, money transforms from a simple tool for immediate consumption into a strategic means for achieving personal sovereignty and lasting freedom.

First: The Philosophy of Wealth and Debunking Visual Deception

The first and most important step in the journey of financial awareness is the fundamental distinction between what you show to others and what you actually own in your investment accounts.

-

The Illusion of Being Rich. This is a lifestyle that relies entirely on high spending to give an impression of financial capability. This pattern is often drained from current income or built on burdensome consumer loans to satisfy temporary social desires, making a person “rich in appearance” but “poor in financial substance.”

-

The Essence of True Wealth. This is the net value of assets you own that generate passive income or grow in value over time. Wealth is the money you decided “not to spend” today to buy your security tomorrow; it is the only guarantee that protects you from economic fluctuations and grants you options that were never available before.

Second: The Psychology of Spending and the Lifestyle Inflation Trap

The “Ego” or the desire for social imitation is the primary driver behind losing great financial opportunities, as individuals tend to raise the ceiling of their expenses as soon as they achieve any increase in income.

-

Lifestyle Inflation. An increase in salary does not necessarily mean an increase in wealth if expenses rise by the same percentage or more. Controlling this inflation is what creates the “financial surplus” that represents the cornerstone of any successful investment process.

-

Financial Gap Analysis. True financial strength is not measured by the total salary figure, but by the volume of savings relative to spending. An individual who earns 2,000 JOD and spends it all is in a much weaker financial position than someone who earns 600 JOD and regularly saves 150 JOD.

Third: The Time Value of Money and the Miracle of Compounding

Time is the most influential variable in the wealth-building equation, and understanding it deeply changes the way you view every daily purchasing and saving decision.

-

The Power of Exponential Growth. Early investment gives money the chance to grow through compounding. The amazing results of wealth building do not appear in the first years but multiply significantly in the advanced stages as a result of consistency, silent patience, and commitment to a long-term plan.

-

Opportunity Cost. Financial awareness requires you to compare the value of the commodity you buy today with its potential investment value a decade from now. Every ill-considered consumer financial decision is, in fact, a sacrifice of a precious piece of your future financial freedom.

Fourth: Money as a Tool for Personal Sovereignty and Freedom

The ultimate value of money does not lie in owning real estate or luxury cars, but in the superior ability to own your decisions and have full control over your schedule.

-

Buying Security and Time. Financial independence provides you with an “emergency fund” and a “safety portfolio” that allows you to say “no” to exhausting professional circumstances or personal decisions that pressure your dignity. Money here acts as a fortified shield protecting your personal independence.

-

Liberation from the Dependency of Forced Labor. When the returns on your assets exceed your basic expenses, the concept of work transforms from a “harsh necessity for survival” into a “free choice for development and creativity.” This is the true and deep definition of financial freedom that everyone seeks.

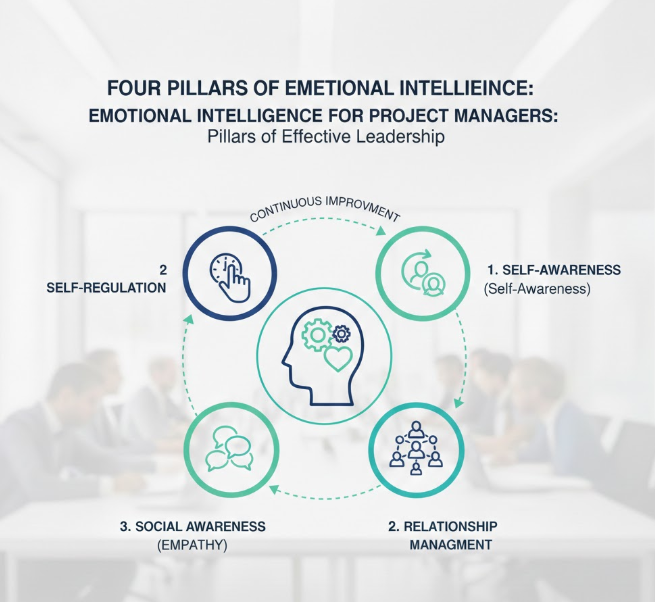

Fifth: Managing Emotional Biases and Behavioral Awareness

As human beings, we are not entirely logical creatures in our financial decisions; rather, we are emotional beings who justify our actions with logic afterward.

-

Facing the Fear and Greed Dualism. Fear drives individuals to flee markets during crises (missing golden opportunities), while greed drives them to take uncalculated risks during financial peaks. Awareness of these emotions is the first step to avoiding major losses.

-

Examining Spending Motives. High financial culture requires examining the psychological triggers that drive us to buy. Do we spend to satisfy a real need, for emotional compensation, or simply to keep up with a certain social circle? Understanding these motives frees you from the slavery of momentary consumption.